Bulletin 130 | John Roberts, Adele Groyer, Dan Ryan, Matt Fletcher

COVID-19 is still one of the hottest topics for scientific papers and articles. The COVID‑19 Actuaries Response Group provides a regular fortnightly update with a summary of the key papers and analyses that we’ve looked at recently.

In this issue, we look at – amongst other things:

- Vaccines for 16-17 year olds

- Benefits of delaying the second dose

- Delta ‘vaccine avoiding’ infections

- Behavioural nudges to improve vaccine take-up

- SAGE’s thoughts on waning vaccine effects

- Risks of MI and stroke after COVID-19

- Increasing virulence of SARS-CoV-2 variants

- Actual hospital admissions vs recent projections

- ONS antibody and infectivity reports

- CHIME: COVID-19 Health Inequalities Monitoring for England

- R is probably below 1 in England

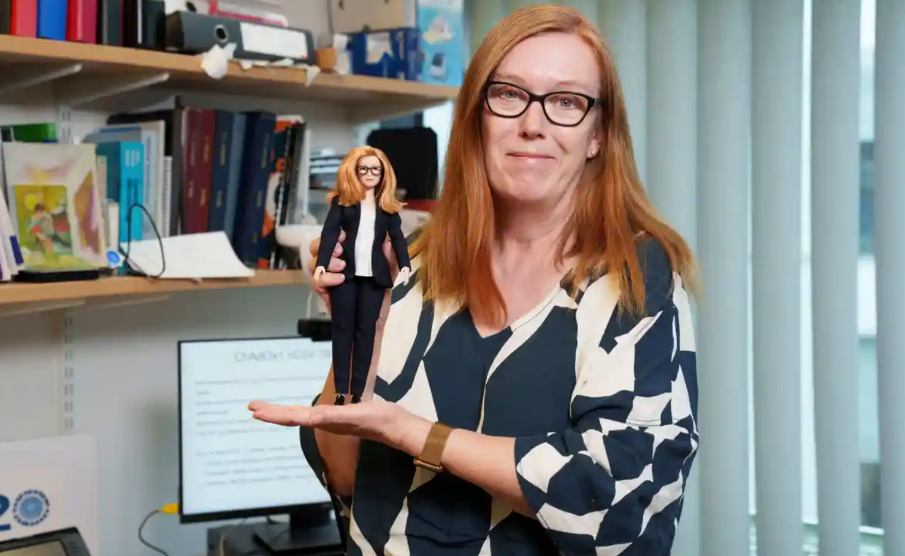

And finally, a COVID-busting Barbie doll ….