England’s booster rollout is failing to keep pace with the rollout of first and second vaccine doses. This means that a large and growing population have not yet received their booster, despite receiving their second dose more than six months ago.

3.7 million* third doses have been given in the month since the booster rollout started (as recorded in today’s daily update from NHS England).

But if we look back six months, 8.5 million had already received their second dose. So 4.8 million are eligible but are yet to receive their booster, a number which has been growing.

Current Rate

Currently, the NHS is giving around 1.3 million vaccinations each week. But over 2 million are becoming newly eligible each week. So the “backlog” of those eligible but not jabbed will increase steadily unless the rate of boosters given increases substantially.

For the over 80s, we’ve currently jabbed 1.3 million, out of 2.4 million who are eligible. That’s just over half the population. In addition, a small number of over 80s have yet to pass the six month threshold but will shortly become eligible too.

At the start of the booster campaign, the Secretary of State for Health and Care stated that the aim was to protect “those most vulnerable to COVID-19 as we head into the autumn and winter months”. But at the current rate, it’s likely to be towards the end of January before the approximately 22m that fall into those most vulnerable groups (Priority Groups 1 to 9) receive the booster.

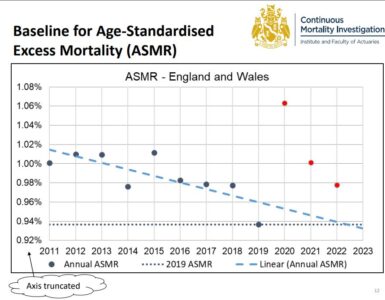

Effectiveness

But surely vaccines are highly effective against serious illness and death? Certainly they are, but they are not 100% effective. And there is growing evidence that over time that effectiveness is waning. Data from Public Health England in September suggests that the “effectiveness gap” roughly doubles between the third and fifth month following the second dose. This varies by vaccine, dosing interval for the primary course, and whether the individual is clinically extremely vulnerable or not.

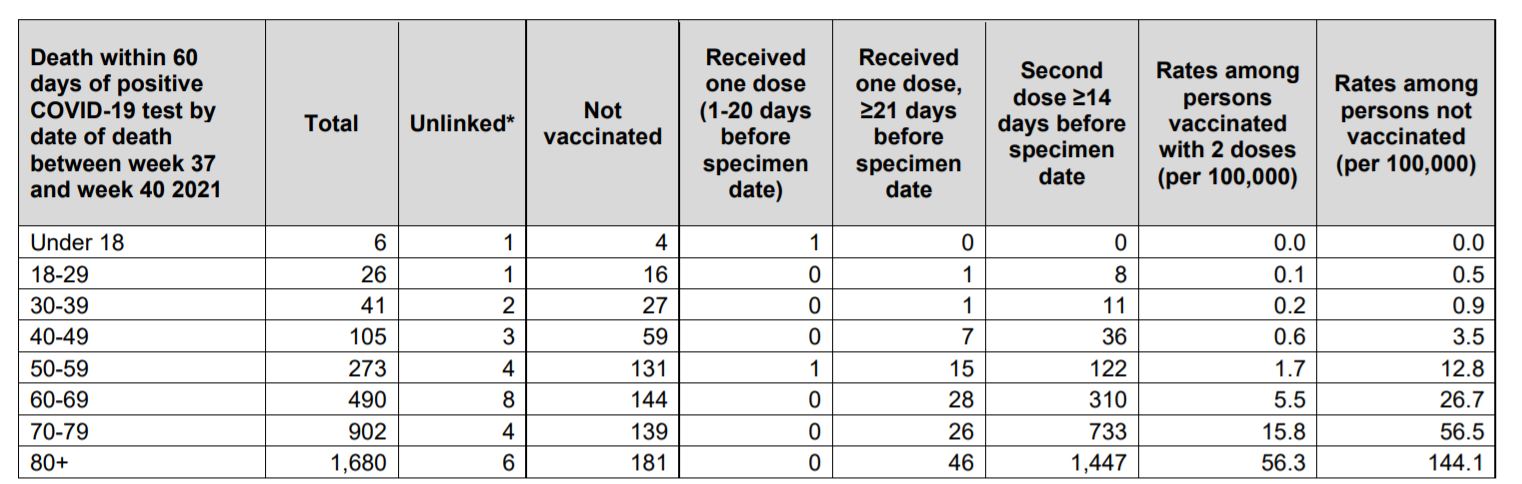

There’s more evidence of the effectiveness gap in the latest data from the UK Health Security Agency. Over 1,400 deaths associated with COVID were recorded in the last four weeks among those aged over 80 who had been fully vaccinated.

We don’t explore here in detail the reasons for the relatively slow progress, other than to note that supply is not considered to be the limiting factor, unlike in the initial roll-out. However, we do know that this time GP practices are currently heavily involved in this winter’s flu vaccine campaign, itself a major logistical exercise. This must limit their capacity to some degree. Another factor where data is not available relates to the population’s enthusiasm to accept the booster invitation at the earliest opportunity.

Case numbers are very high and still rising. Cases in the over 50 age group have risen by around 50% in the last two weeks. Admissions to hospital are also rising again. It’s clear that accelerating the booster rollout is vital to reduce the pressure on health services. This will help to minimise COVID-related deaths this autumn and winter.

I discussed these issues on the Today programme on Radio 4, alongside JCVI member Professor Adam Finn. You can listen to the show here (we’re on in the last 11 minutes).

* Some of the 3.7 million are third primary doses for those who are immunocompromised. These people will become eligible for a booster themselves in due course. NHS England does not differentiate between the two when reporting, so we are unable to identify them separately.