With the high prevalence of self-reported Long Covid in the UK, we are starting to get questions about whether insurers are paying more disability claims. Some are also asking whether insurers have increased disability insurance (“Income Protection”) premiums because of Covid. As actuaries, many of us work in the insurance industry. In this blog we share what we know about the current situation.

Disability insurance in the UK

In the UK, “Income Protection” is the name given to products that pay an income to an insured person who is unable to work because of an illness or an injury[1]. Claim validity is determined by symptoms and effects, and not by a diagnosis. The nature of the insured person’s job also affects claims. For example someone who works in a sedentary job can more easily continue to work, despite health issues.

Income Protection cover may be provided as part of an employee group scheme. It can also be purchased by the individual.

Policies require the insured person to be unable to work for a minimum period before an income will be paid. This is called a “waiting period”. In group cover this period can vary but is typically 6 months. In individual cover, this period can range from day 1 cover to 12 months.

Demographic profile of people with Income Protection insurance

According to the UK Labour Force Survey, there are 32.7 million people in employment. Only around one-in-ten of the workforce has Income Protection insurance. 2.8 million people are insured under group arrangements[2] and there are fewer than 1 million individual Income Protection policies.[3]

While cover is available to people in most occupations, coverage is highest among those who work in professional, managerial and administrative roles. Therefore claims data from insurers is not representative of occupational disability in the general population. Additionally, the insured demographic has been in a better position to work remotely and thereby avoid catching Covid, at least early on in the pandemic.

Group Income Protection claims statistics

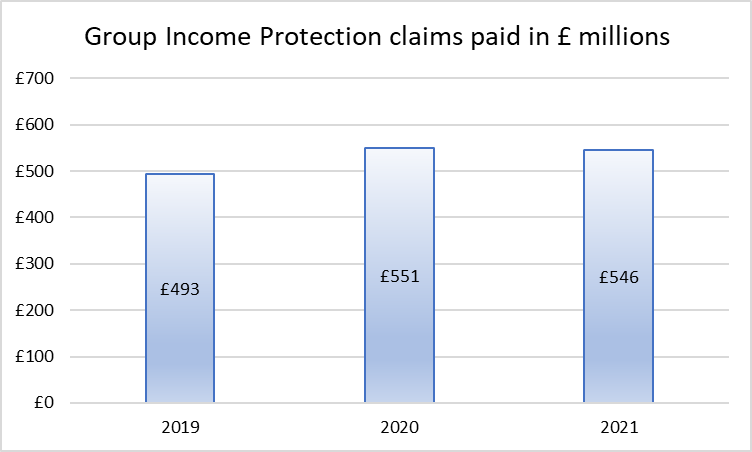

Group Income Protection saw a 12% increase in total claim payments between 2019 and 2020 but claims paid in 2021 were slightly lower than in 2020.[4]

The claims data shown here reflects all payments that insurers made in a particular year. Many of these payments relate to claims that started in previous years. There were 15,998 claims in payment in 2021.

There were 372 new COVID-related claims in 2021 and COVID was the fifth most common cause among new claims. 66 of these claimants had returned to work by the end of the year. There were 41 COVID-related claims in 2020.

Individual Income Protection claims statistics

In contrast to Group Income Protection, there was a decrease in the number of individual Income Protection claims paid. The Association of British Insurers (ABI) reported that there were 17,000 individual Income Protection claims in 2020 but only 14,600 claims in 2021.

The ABI report suggests that the fall in claims could have resulted from people still benefiting from furlough benefits or from insurers providing more specialist support services and rehabilitation schemes.[5] We speculate that another factor could be the normalisation of working from home. More flexible working arrangements, with reduced travel, mean those affected by health issues are now better able to continue to work.

Aviva is a large insurer and paid 4,300 of the industry’s individual Income Protection claims in 2021. Aviva reported that 5.9% of new claims arising in 2021 were due to Covid. We estimate this amounts to around 80 claims, assuming that one third of claims paid arose in the latest year. While Aviva paid out £51.2m for all Income Protection claims, only £376,000 was in support of customers impacted by Covid. Aviva reported that 91% of individual Income Protection customers who received support for Long Covid returned to work following the introduction of a specialist Long Covid claims pathway. Additionally rehab support specifically for Long Covid accounted for 12% of all rehab support that Aviva provided in 2021.[6]

LV=, another large Income Protection insurer, paid £16.3m spread over around 2,000 claims in 2021.[7] This is similar to the number and value of claims they paid in each of 2019 and 2020.[8] [9] In 2021 Covid accounted for 209 Income Protection claims with around £700,000 paid.

Interestingly LV= has split out their claims data for their two types of disability products. In total, there were 950 claims in payment on their traditional Income Protection product.[10] Of these, 15% were new claims and 4% of new claims were in respect of Covid. This suggests that they paid just six Covid claims on the traditional Income Protection portfolio. Therefore almost all Covid claims arose on their Personal Sick Pay portfolio. Covid was the second most common cause of claim on this portfolio and accounted for 21% of new claims.

LV=’s Personal Sick Pay cover is sold with very short waiting periods to cater for people who are self-employed or who get little sick pay from their employer. The product is largely aimed at people who work in manual occupations. This suggests that the majority of Covid claims were for the work impacts of initial Covid infection rather than Long Covid.

The data available for 2021 does not suggest that there have been significantly more claims due to Covid.

Is COVID-19 increasing Income Protection premiums?

There is increased uncertainty in pricing for Income Protection. This is because of direct and indirect pandemic impacts[11], along with other factors such as the state of the economy. Increased uncertainty puts upward pressure on premiums. However, the UK protection market is highly competitive which puts downward pressure on premiums.

For Group Income Protection, Swiss Re’s Group Watch reports that the value of cover increased by 6% while premiums increased by 8.6% between 2020 and 2021. This suggests a 2.6% increase in premiums.[12]

For new Individual Income Protection policies, Gen Re’s Protection Pulse shows that total sales by premium volume in 2021 was 3.8% lower than in 2019.[13] In additional correspondence, Gen Re confirmed that the average premium per new policy has not increased relative to the pre-pandemic average.

Note that on individual protection policies, policyholders may elect to have fully guaranteed premiums. This means the insurer cannot change the premiums from the schedule promised at outset under any circumstances. For policyholders who have selected a product with reviewable premiums, the insurer may adjust premiums to reflect changes in claims experience.

Conclusions

Income Protection cover provides an income when Covid or any other health-related issue affects the ability to work. Cover is assessed based on impact, rather than on diagnosis. Insurers also provide additional rehabilitation support to aid return to work.

The financial value of Covid claims paid to date is small relative to the value of claims otherwise paid by Income Protection insurers. Most Covid claims have arisen on policies with short waiting periods and most of the people claiming have returned to work rapidly.

There is little evidence of increases in premiums resulting from Covid.

The insured population is not representative of the general population. It is certainty plausible that in the general population there is higher prevalence of Long Covid that is severe enough to affect ability to work.

But for the hundreds of people who have received insurance benefits to date, the money and other support services will have relieved some of the worry that comes with suffering from Covid-related health issues.

[1] https://www.abi.org.uk/products-and-issues/choosing-the-right-insurance/income-protection/

[2] Swiss Re Group Watch 2021

[3] Estimated from 2018 ABI long-term insurance data https://www.abi.org.uk/data-and-resources/industry-data/free-industry-data-downloads/

[4] GRiD data https://grouprisk.org.uk/2021/05/14/employer-sponsored-group-risk-benefits-pay-record-claims-to-employees-during-2020 and https://grouprisk.org.uk/2022/05/12/employees-benefit-as-group-risk-industry-pays-out-record-amount-in-claims-during-2021

[5] https://www.abi.org.uk/news/news-articles/2022/05/payouts-for-bereavement-illness-and-injury-claims/

[6] https://connect.avivab2b.co.uk/adviser/articles/news/protection/2021-individual-protection-claims-results/

[7] https://www.lv.com/about-us/press/lv-protection-claim-payouts-hit-119-million-in-2021

[8] https://www.lv.com/about-us/press/lv-protection-claim-payouts-hit-one-hundred-million-pounds-in-2019

[9] https://www.lv.com/about-us/press/lv-protection-claim-payouts-hit-almost-118million-in-2020

[10] https://www.lv.com/-/life/media/pdfs-lvfs/life-insurance/2021-claims-infographic

[11] https://covidactuaries.org/2022/05/05/the-legacy-of-the-pandemic/

[12] https://healthcareandprotection.com/group-risk-coverage-up-5-9-as-premiums-rise-9-swiss-re/

[13] https://knowledge.genre.com/protection-pulse-2021-review?hsLang=en