South Africa has seen one of the highest burdens of excess deaths globally during the COVID-19 pandemic. It is estimated (by MRC and UCT researchers) there have been more than 260,000 excess natural deaths since the start of the epidemic up to 18 September 2021. This measures the excess of all registered deaths due to natural causes since May 2020 compared to the expected natural deaths (based on projections from past death patterns).

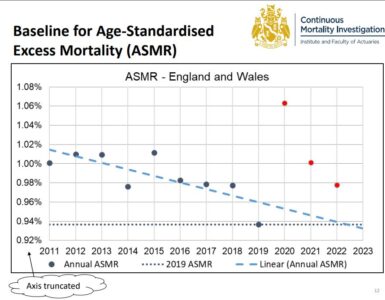

The graph below (from the linked report) shows the total deaths (in black) and the forecast of deaths that would be typical for a normal year (in orange) from all causes.

The figure of 260,000 equates to 437-per-100,000 or indeed 0.437% of the population of South Africa. These deaths are strongly correlated with cases and reported COVID-19 deaths in South Africa, and are thought to be largely due to COVID-19. The pattern of excess deaths follows the waves of the infections, increasing and decreasing over the period which suggests a direct association with infections. The researchers estimate that the majority (85% to 95%) of these deaths are directly attributable to COVID-19.

A question one might ask is “what are the implications for the life insurance industry?” Is managing a life insurer in a pandemic not akin to selling home and car insurance in the middle of a hailstorm?

Before the pandemic, the Actuarial Society of South Africa had been working with insurers to study the mortality experience of Protection insurance products before the pandemic struck The Continuous Statistical Investigation (CSI) committee, that was doing the work, saw the opportunity to ask insurance companies to contribute data more frequently, to allow actuaries to observe the impact of the pandemic on life insurance mortality. The work is focussed on Protection products that require full application questionnaire and underwriting procedures to be completed. This excludes group business, business written with simplified questions, as well as funeral business.

The committee asked companies to contribute claims data as well as exposure data in summarised monthly form from 2018. They then used the 2018 and 2019 data as a basis to set expected claim numbers and compared this with what has happened in 2020 and 2021. The committee initially released some results on 1 June 2021 but has been updating it since. They have been trying to keep the updates regular but are somewhat hampered by constraints of the contributing companies.

Below, some of the early results of the work are shared. This includes data for the third wave up to the end of August (for companies that have already submitted it). The online version of the dashboard (available after free registration) includes data before the third wave and will be updated once all companies have submitted.

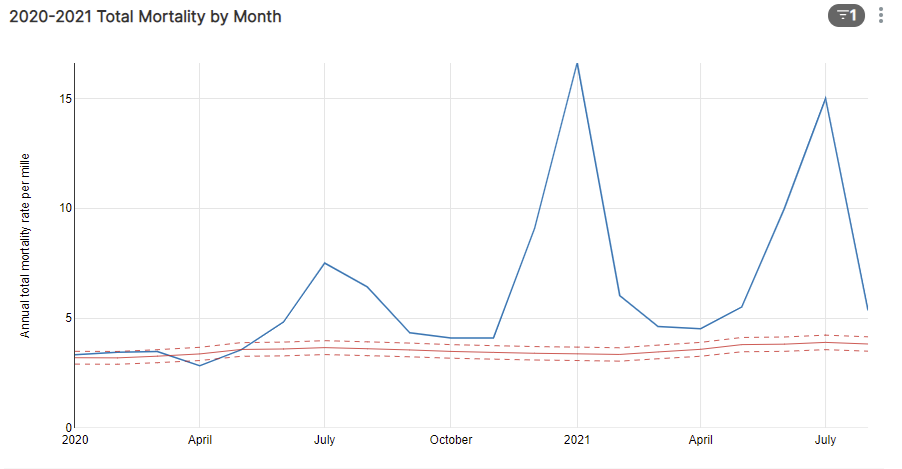

The graph below shows the expected death rate per mille over the period, in red with a confidence interval around it. The actual death rates in blue are well in excess of the expected figures during the three waves.

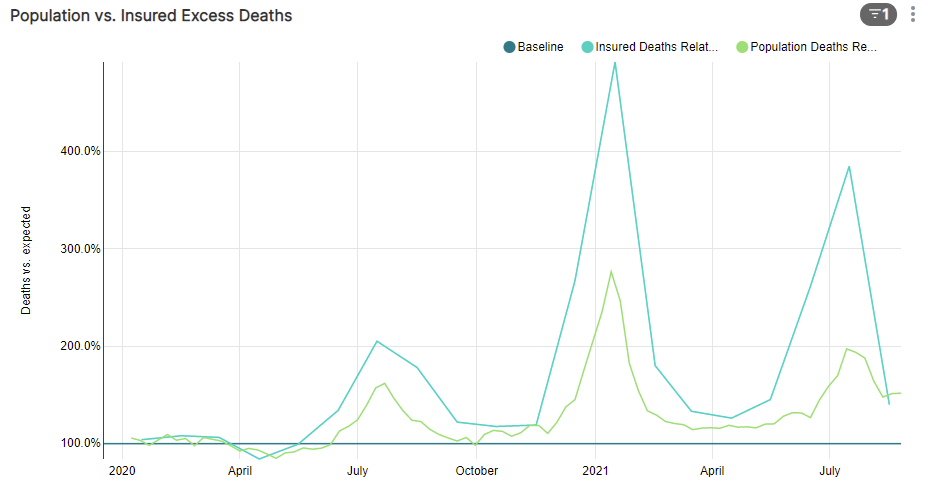

In the graph below, the CSI compares the population and insured numbers. This shows actual vs expected claims where the expected claims would represent 100% on the graph. The green line shows the general population deviation from expected. It is clear that during the second wave of the pandemic, population deaths peaked at 2-to-3 times the expected figures. However, if we look at the insured experience, we can see that during the second wave, deaths were in excess of 4 times expected. During the third wave, deaths are also nearing 4 times expected. No allowance for late reported claims has been made in this analysis, so the results may worsen as more data is collected.

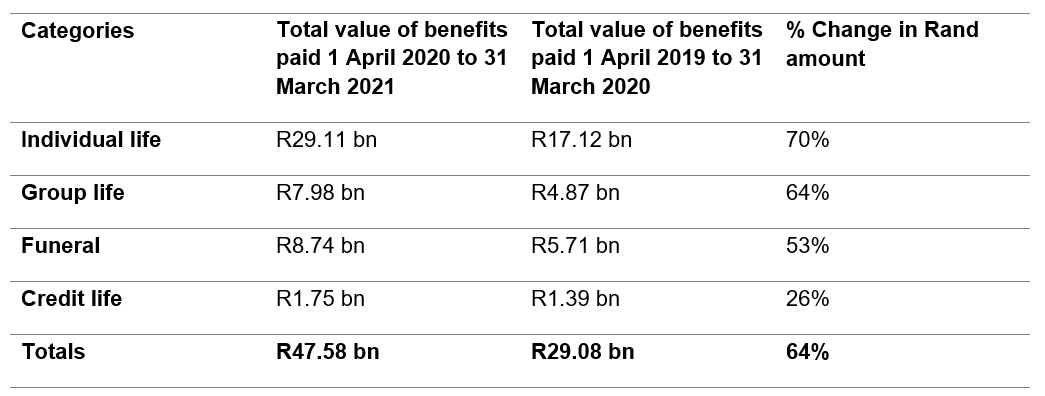

The Association for Savings and Investment South Africa (ASISA) which is also the life insurance industry body has also released claims statistics relating to COVID-19. These demonstrate that excess death experience is reflected across the full ambit of life cover experience, including group and funeral policies. The table below summarises the benefits paid during the period 1 April 2020 to 31 March 2021 compared to the preceding year. It shows increases across all products with the overall increase in claims of 64%.

In a further release ASISA states that despite the increase in claims the industry remains well capitalised. It also noted increased sales of risk policies as well as reduced lapsation of policies. The body goes on to “urge all South Africans to get vaccinated rather than risk death or the long-term debilitating side effects often caused by COVID-19”.

Based on evidence of continued excellent safety and efficacy of both the Pfizer and Johnson & Johnson (J&J) vaccines (the two vaccines in use in South Africa) against the Delta variant, life insurers see vaccination as key to restore some sense of “normality”. Pfizer is thought to be in excess of 95% effective at protection against hospitalisation and death from Delta (based on Public Health England research). South Africa’s own Sisonke trial established that the J&J vaccine is 91.0%-96.2% effective at protecting against death from Delta.

It is difficult for life insurers to access data on the vaccination status of their policyholders but some initial findings from Momentum Life indicate that “only 2% of recent deaths claims were for fully vaccinated people”. As the numbers of people that are vaccinated increase, especially amongst the elderly, that proportion is bound to increase, but figures to date are clearly an encouraging sign of the protection offered by vaccines. It should then hardly be surprising that insurers are considering differentiating pricing and rewarding policyholders who are vaccinated in future.

We are starting to understand that COVID-19 will become endemic and something we will continue to live with for some time. There remains significant uncertainty with regard to the future course of the pandemic and this uncertainty is heightened by the potential emergence of further variants.

Vaccines offer robust protection against these future uncertainties, but despite this, it is saddening to still see death claims being paid out to the families of elderly people and healthcare workers who, tragically, could have been vaccinated a long time ago.